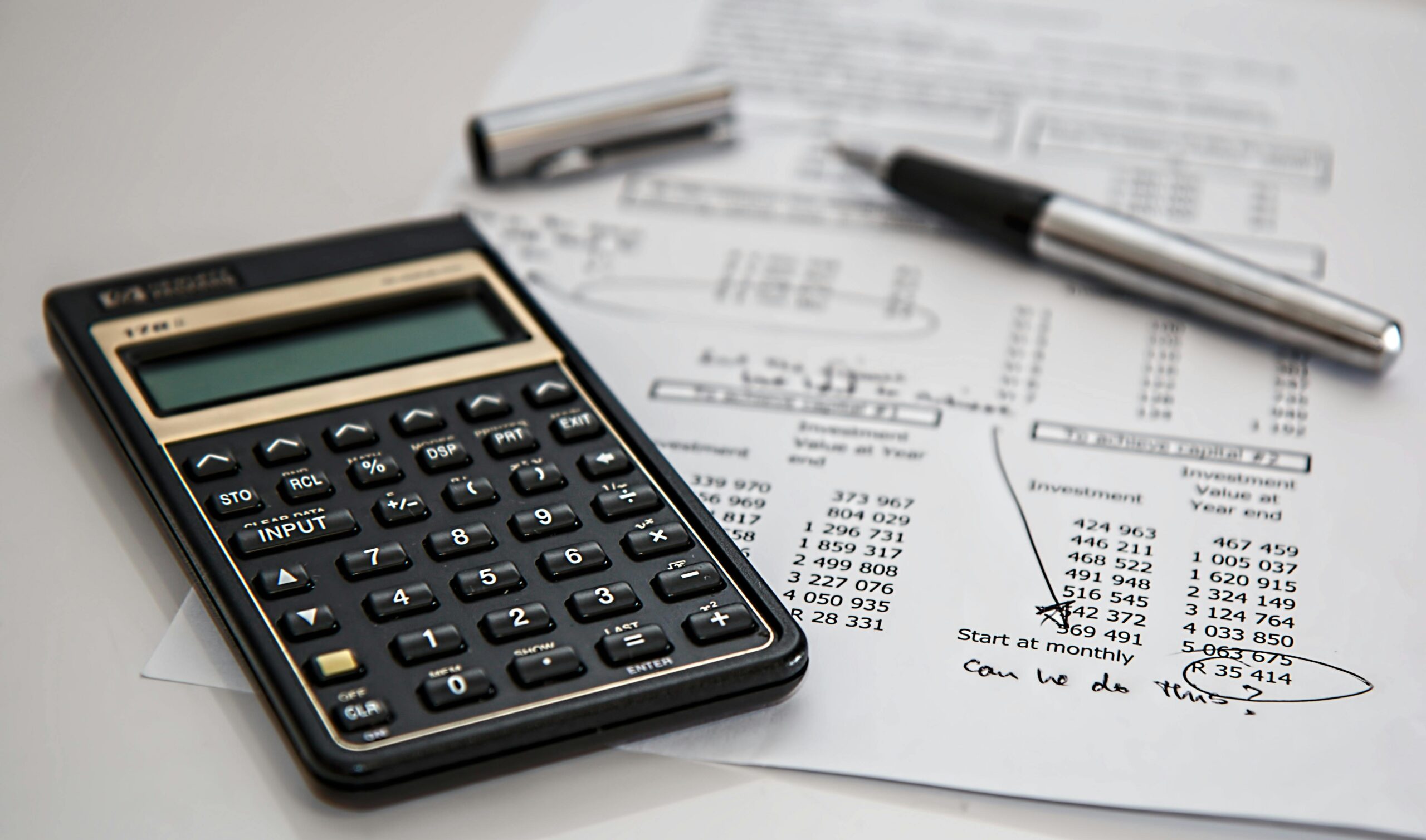

If you employ staff in Australia, you must be using Single Touch Payroll (STP). It’s a mandatory reporting system introduced by the ATO that changes how and when you report payroll information.

What is Single Touch Payroll?

STP is an ATO initiative that requires employers to send their employees’ salary and wage information, pay as you go (PAYG) withholding, and superannuation information to the ATO each time they run their payroll.

Instead of reporting this information once at the end of the financial year, you are now required to report it in “real-time” through STP-enabled software.

Why is STP Mandatory?

The ATO made STP mandatory to create a more streamlined and transparent system. The key benefits are:

- Improved Transparency: Employees can see their year-to-date tax and super information through their myGov account.

- Level Playing Field: It ensures all businesses are complying with their PAYG withholding and superannuation obligations.

- Streamlined Reporting: It eliminates the need for employers to provide payment summaries (group certificates) to employees at the end of the financial year.

What Are Your Employer Obligations?

As an employer, your key employer obligations under STP are:

- Use STP-Enabled Software: You must use payroll or accounting software that is STP-compliant (like Xero, QuickBooks, or MYOB).

- Report on or Before Payday: Each time you pay your employees, you must submit an STP reporting event to the ATO.

- Finalise Your Data: At the end of the financial year, you must make a finalisation declaration. This confirms your STP data is complete and accurate for the year.

STP is a fundamental part of the ATO payroll system. Ensuring you are compliant is not just a legal requirement; it helps you run a more efficient and transparent payroll process.